Sales tax compliance is a crucial aspect of any organization that sells taxable goods or services. Staying compliant can be challenging, especially considering the ever-changing regulations and complex calculations involved. In addition to complying with state and local tax laws, associations must also consider the sales tax nexus. This is where sales tax automation tools like Avalara can make a significant difference.”

The fusionSpan Blog

Sales Tax Nexus: What Is It and Why Is It Important?

What is Sales Tax Nexus?

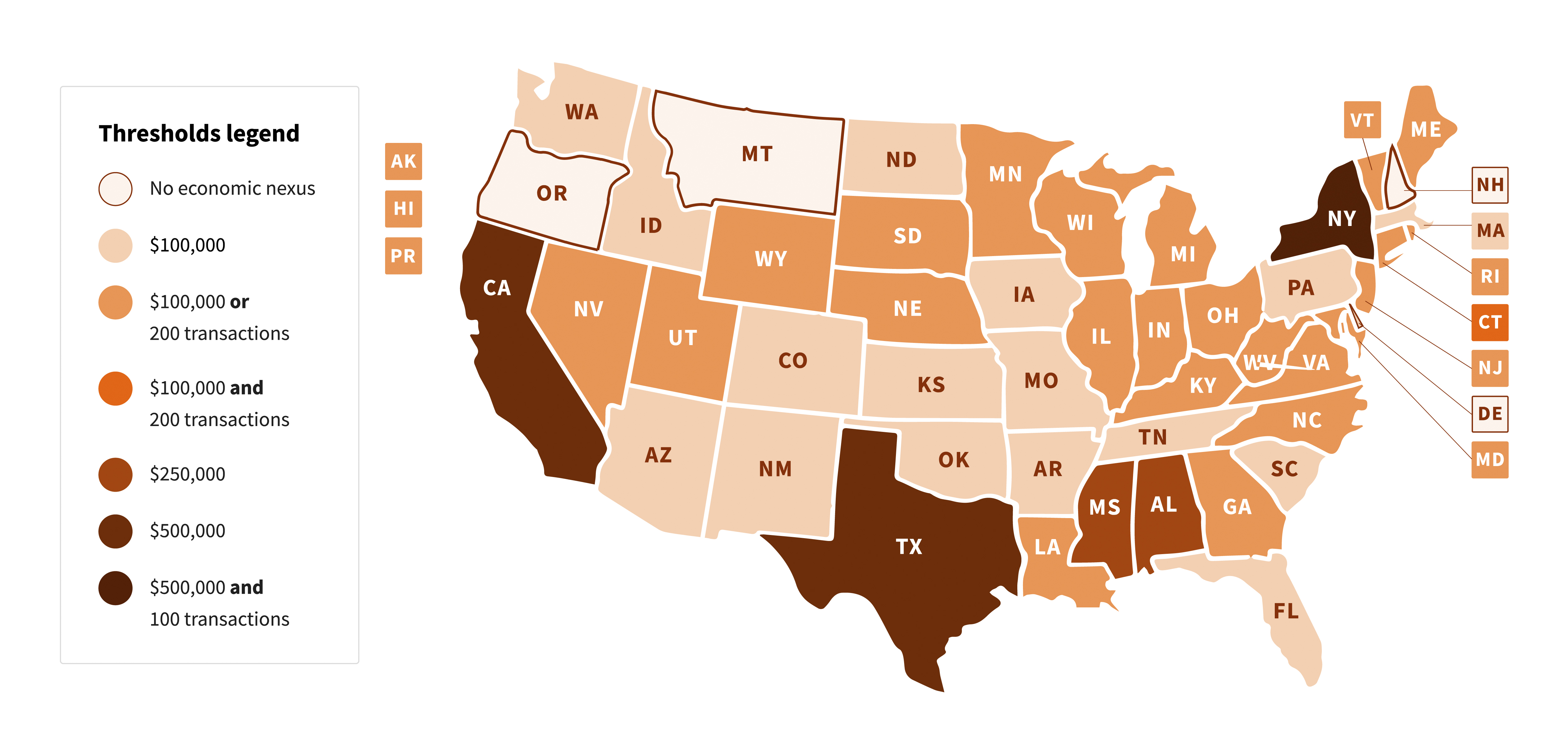

Sales tax nexus refers to the connection between an organization and a state that requires the business to collect and remit sales tax on taxable sales. An organization must have sales tax nexus in a state to be obligated to collect and remit sales tax. Nexus can be established through various activities, including having a physical presence in a state, selling a certain amount in a state, or engaging in other activities that create a connection between the organization and the state.

Sales tax nexus refers to the connection between an organization and a state that requires the business to collect and remit sales tax on taxable sales. An organization must have sales tax nexus in a state to be obligated to collect and remit sales tax. Nexus can be established through various activities, including having a physical presence in a state, selling a certain amount in a state, or engaging in other activities that create a connection between the organization and the state.

Why is Sales Tax Nexus Important?

Failing to comply with sales tax nexus regulations can have severe consequences for organizations, like penalties, fines, and even legal action. It is essential to understand the rules for establishing nexus in each state where an organization operates and to comply with the requirements for collecting and remitting sales tax.

Sales Tax Automation Tools and Sales Tax Nexus

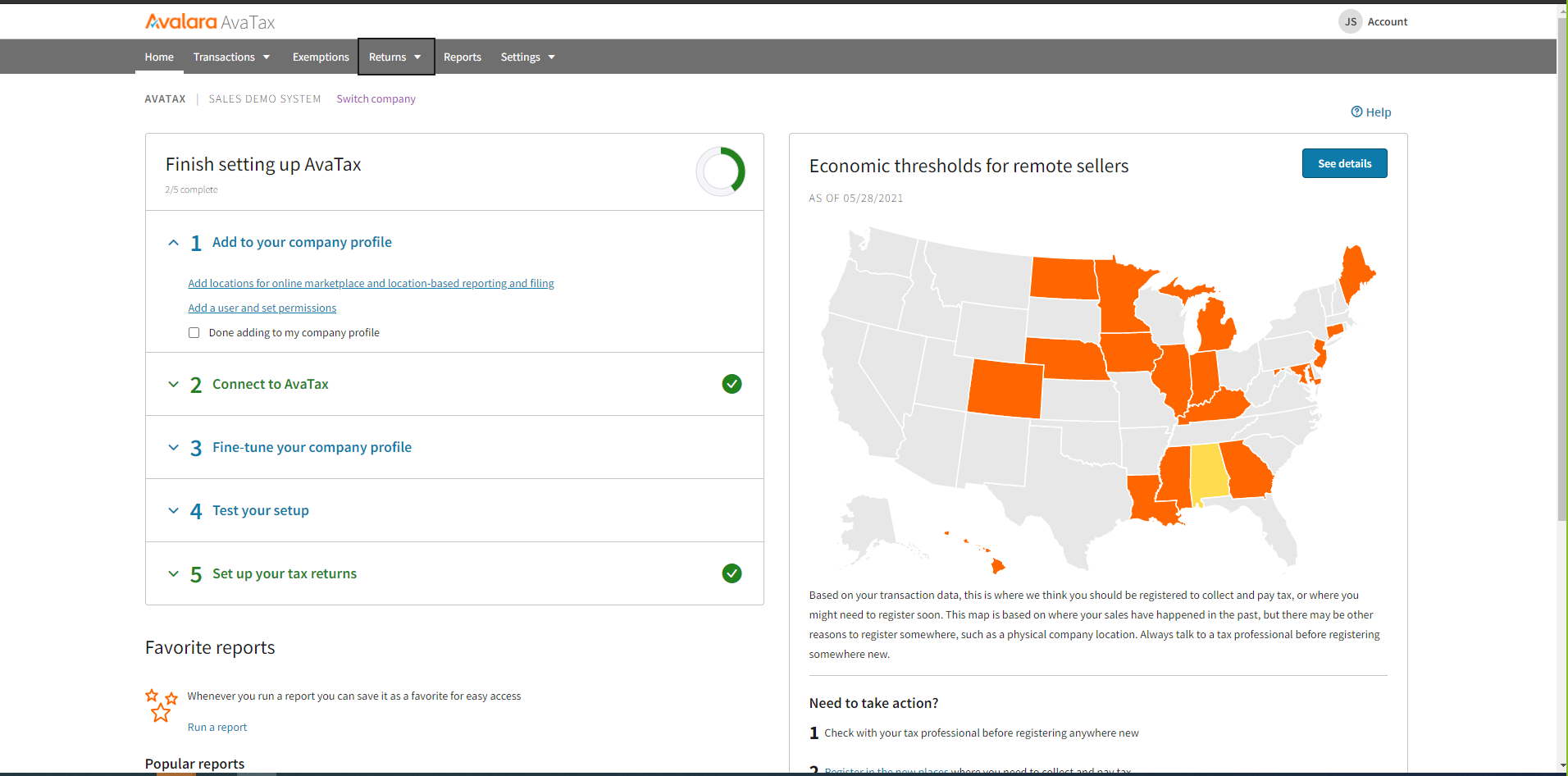

Sales tax automation tools like Avalara can help businesses stay compliant with sales tax nexus regulations. These tools automate the sales tax calculation process, making it easy for businesses to accurately calculate and collect sales tax from customers. They also simplify the process of remitting sales tax to the appropriate tax authority.

Sales tax automation tools like Avalara can help businesses stay compliant with sales tax nexus regulations. These tools automate the sales tax calculation process, making it easy for businesses to accurately calculate and collect sales tax from customers. They also simplify the process of remitting sales tax to the appropriate tax authority.

Avalara offers a range of features to help businesses stay compliant with sales tax nexus regulations, including real-time tax rate calculations, tax exemption management, and tax reporting and filing. These tools integrate with various accounting and e-commerce platforms, which makes it easy for businesses to implement.

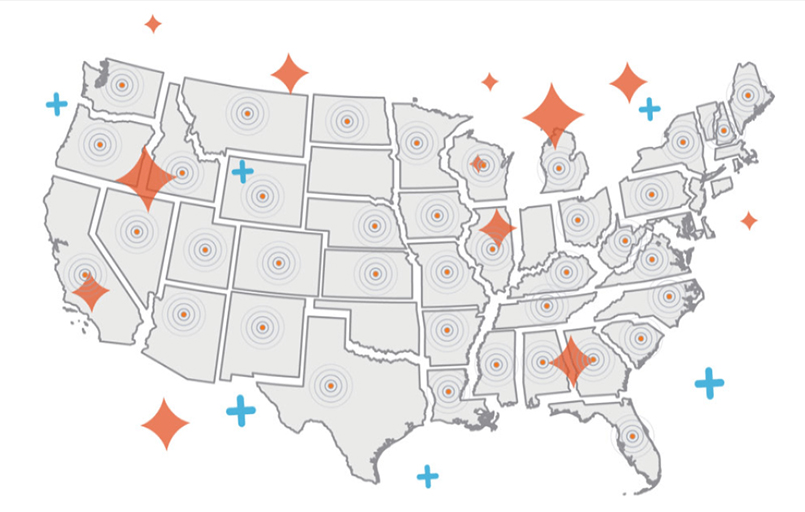

Sales Tax Nexus and Multi-State Operations

If an organization operates in multiple states, it is crucial to understand the rules for establishing sales tax nexus in each of those states. Each state has its own rules for establishing nexus, and it is essential to comply with each state’s specific rules to avoid penalties and fines.

Sales tax automation tools like Avalara can help businesses manage sales tax nexus in multiple states. These tools can automatically calculate the appropriate tax rate based on the rules for each state, simplifying the process of collecting and remitting sales tax.

Incorporating Avalara with your Fonteva Org

Avalara Avatax can be integrated to add tax components to the orders placed in the Fonteva store. When a product is added to the cart, the tax rates will automatically be retrieved based on the product configuration, and state of delivery of goods/services, and used in tax calculations. The integration will also write back the invoice details to Avalara so that any tax filings can be done directly through Avalara.